By James Sillars, Business Reporter

The rate of inflation remained static at 3% in October – defying expectations of a rise among economists and policymakers at the Bank of England.

The Office for National Statistics (ONS) said rising food prices were largely offset by falling fuel costs last month.

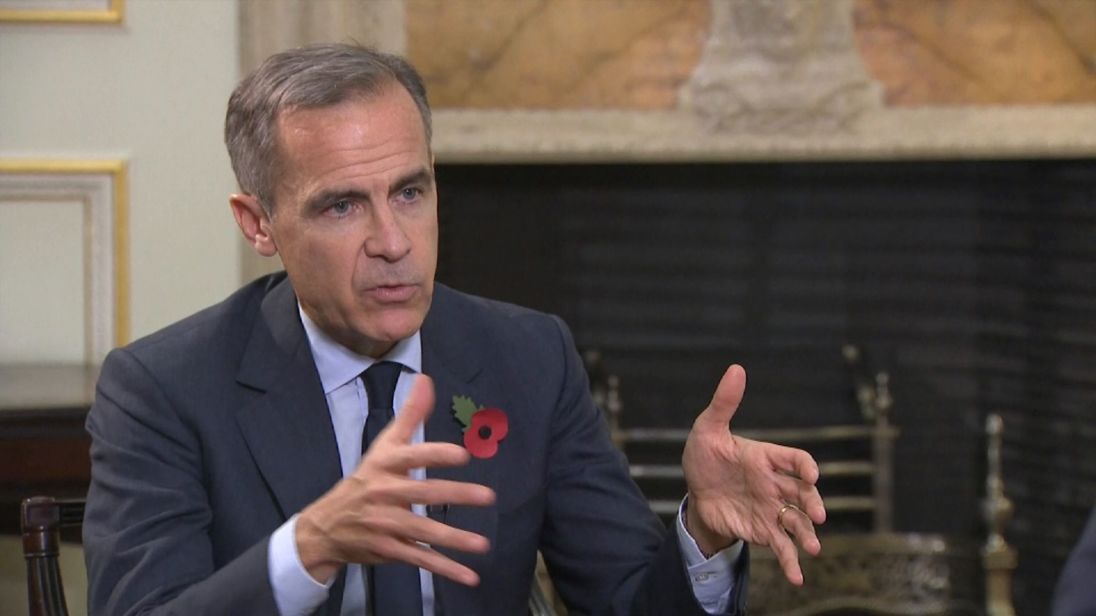

Forecasters had predicted an increase to at least 3.1% – a scenario that would have forced the Bank's governor to write to the Chancellor to explain why the Consumer Prices Index measure had exceeded 3%.

The Bank's inflation target is 2%. It raised interest rates earlier this month to help tackle inflation in its belief the figure was to hit 3.2% in October.

The ONS figures are likely to reinforce doubts among some economists on the wisdom of that rate hike, which has forced up many families' borrowing costs at a time when their spending power is already facing a squeeze.

That is because many of the price increases that have driven inflation to five-year highs were already set to fall out of the inflation calculations early next year.

Higher import costs – a consequence of the weaker pound since the Brexit vote in June last year – have been passed on to consumers while average wage growth has failed to keep up with the pace of price increases.

The ONS said the bulk of the upwards pressure on inflation last month came from vegetables – rising 5.7% on an annual basis ahead of Christmas.

It pointed to a particular contribution from premium potato crisps.

Food prices were 0.6% higher on the previous month while energy costs were 1.3% higher, reflecting the decision by British Gas to raise its default tariffs in September.

While fuel costs were 0.4% down in October compared with the previous month, rising pump prices in recent weeks are expected to loom large in November's inflation calculation.

The pressure on family budgets is a major cause for concern among retailers in the run-up to the crucial Christmas season.

Major grocery chains reporting their progress recently have been at pains to say they are doing their best to shield shoppers from the worst of the rising prices.

Separate industry data released by Kantar Worldpanel showed inflation was accounting for much of the growth in the sector.

In reported a 3.2% annual jump in the value of supermarket sales in the 12 weeks to 5 November while sales volumes grew by less than 1%.

Maike Currie, investment director at Fidelity International, said: "While the Bank of England raised interest rates at the beginning of this month given concerns over inflation, it will take some time for inflation to fall back nearer the Bank of England's 2% target.

"This means cash-strapped consumers will continue to feel the pinch as wages lag price rises.

"Homeowners on variable rate mortgages in particular will be feeling the biggest squeeze having to contend with the prices of everyday goods and services going up, and dealing with rising mortgage repayments."

More stories

- Previous article Coca-Cola slammed over Christmas truck tour

- Next article Tesco's £3.7bn Booker buy provisionally cleared