The Latest: Senate bill adds tax break for family leave

The Latest on the Republican tax overhaul legislation (all times local):

9:50 p.m.

A new tax break for businesses that give their workers paid family leave has been put into the Senate Republican tax bill now moving toward approval.

The proposal by Sen. Deb Fischer, R-Neb., was included in a late revision to the bill written by Sen. Orrin Hatch, chair of the Senate Finance Committee. The panel is debating the bill, which cuts taxes for corporations and many individuals, and doubles the standard deduction. A House tax measure is expected to be voted on by that chamber Thursday.

The family leave provision would give employers a tax credit equivalent to a percentage of the wages paid to employees while on family or medical leave. The idea is to encourage paid time for employees for family responsibilities, relieving some financial pressure.

———

7:25 p.m.

The Senate's tax-writing panel has rejected Democrats' efforts to modify a Republican tax overhaul bill.

Several proposals aimed to protect health care coverage for veterans or people with disabilities, mental illness or opioid addiction if the requirement for individual insurance coverage is ended.

The Republican-led Senate Finance Committee voted 14-12 along party lines against the amendments. It was the panel's third day of work on the Senate bill, which would cut taxes for corporations and many individuals.

In a late addition, the bill also would repeal the so-called individual mandate in Obamacare, under which people must get insurance coverage or face a fine.

The defeated amendments would have required congressional analysts to certify that the elimination of the insurance mandate won't reduce the number of people in those categories covered by health insurance.

———

3:50 p.m.

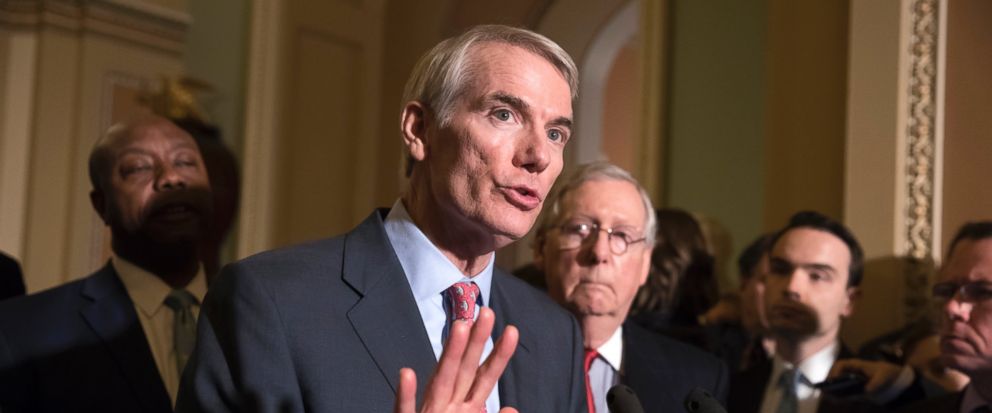

Ron Johnson of Wisconsin has become the first Republican senator to say he opposes the GOP tax bill. That signals potential problems for his party's effort to push the legislation through Congress by Christmas.

Johnson spokesman Ben Voelkel has confirmed Johnson's stance. The lawmaker told The Wall Street Journal he was against the measure because it helped corporations more than other businesses.

The Senate Finance Committee is debating the measure and is on track to approve it by week's end.

Republicans have a 52-48 majority in the full Senate and can afford to lose just two GOP senators and still prevail. Vice President Mike Pence would cast the tie-breaking vote.

GOP Sens. Susan Collins of Maine, Jeff Flake of Arizona and Bob Corker of Tennessee have expressed concerns about the bill.

———

2:15 p.m.

A sweeping tax overhaul has cleared a procedural hurdle in the House.

Lawmakers voted 235-191 on Wednesday for the rule that sets the stage for a vote on passing the measure. That crucial vote is expected Thursday morning after President Donald Trump travels to Capitol Hill to meet with GOP lawmakers.

Republican leaders on Tuesday had projected confidence that they have the votes to pass the bill that would slash the corporate tax rate, reduce the number of tax brackets and eliminate some popular deductions.

Separately, the Senate Finance Committee is working on its version of the bill. The full Senate is expected to vote on that measure after Thanksgiving.

The two chambers need to reconcile the bills in hopes of getting a measure to Trump by Christmas.

——

11 a.m.

The head of the Senate's tax-writing committee is defending the decision to include in the tax bill a repeal of the Obamacare requirement for Americans to get health insurance.

Republican Sen. Orrin Hatch, the chairman of the Senate Finance Committee, said Wednesday the requirement that nearly everyone have insurance coverage or face a fine is a tax.

Hatch said that's a "terribly regressive tax that imposes harsh burdens on low- and middle-income taxpayers." His panel started a third day of work Wednesday on the tax overhaul legislation.

Democrats angrily protested the move. Repealing the mandate would raise an estimated $338 billion that could help pay for deep tax cuts, especially for corporations. Budget analysts say it would push 13 million Americans off the insurance rolls over the next decade.

——

3:43 a.m.

The Obama health care law's requirement that Americans get insurance coverage is now pinned as a target of Republican lawmakers. They are looking to end the individual mandate to help pay for deep tax cuts.

Senate Republicans showed Tuesday they're intent on scrapping the Affordable Care Act's insurance mandate, and the idea was endorsed by scores of GOP lawmakers in the House.

The surprise renewal of the failed effort to eliminate the law's mandate came a day after President Donald Trump renewed pressure on Republican lawmakers to include the repeal in their sweeping legislation to revamp the tax system.

- Star